nj tesla tax credit 2021

GENERAL MOTORS GM Bolt. The residential ITC drops to 22 in 2023 and ends in 2024.

Used Tesla For Sale In Baltimore Md Cargurus

The Clean Energy Act for America would benefit Tesla by allowing most Tesla vehicles to qualify for an 8000 House version or 10000 Senate version refundable EV electric vehicle tax credit while discouraging Chinese EVs from entering the US market.

/ap814720993638-5bfc383d46e0fb0051c14a81.jpg)

. Full Tax Credit. State Local and Utility Incentives. Focus EV 2012-2018 7500.

Louisianas legislature having solved all other problems acted last June to end its 2500 EV purchase tax credit six months early on July 1 2021 six months ahead of the end-of-2021 date earlier enacted. Since it is a tax credit you do not get it immediately upon purchasing the EV. In May 2021 the Senate finance committee considered the Clean Energy for America Act that suggested modifications to a number of existing programs associated with clean energy among them being the EV tax credit.

Relaxed area for all around discussion on Tesla this is the official Lounge. If you purchased a new EV in May of 2021 you would apply for the tax credit when you file your 2021 taxes at the beginning of 2022. 0 You Save 7425 112090.

5432B-855 The New Jersey Sales and Use Tax Act provides a sales and use tax exemption for zero emission vehicles ZEVs which are vehicles certified pursuant to the California Air Resources Board zero emission standards for the model. Tesla 2021 Model Y long range AWD 326. In the House version an 8000 tax credit excluding the Model 3 Performance S and X but in the Senate version a 10000 tax credit excluding the Model 3 Performance S and X on 2022 tax.

New Jersey already waives its 7 sales tax on electric vehicle. The Consolidated Appropriations Act of 2021 signed December 27 2020 provided a two-year extension of the Investment Tax Credit for solar. EV Federal Tax Credit for 2021 Tesla.

5000 0 You Save 3200. You apply for the EV federal tax credit when you file your taxes for the year you purchased the vehicle. Turnpike getting electrified.

This includes US automakers like Tesla who topped over 200000 qualified plug-in electrics sold a few years ago and as a result no longer qualifies for any federal tax. 14500 Approximate system cost in New Jersey after the 26 ITC in 2021. New Jersey was offering money back but that program expired.

According to Mark Steber chief tax information officer at Jackson Hewitt if we assume only a standard deduction and no other credits a single filer will need an income of 65964 in 2021 up. Combined with the federal tax credit of up to 7500 EV drivers in the Garden State were getting as much as 12500 off the. Average-sized 5-kilowatt kW system cost in New Jersey.

The Federal tax credit for Tesla vehicles was phased out to zero at the end of 2019. Sales and Use Tax Exemption. But when combined with the federal tax credit of up to 7500 EV drivers in the Garden State can get as much as 12500 off.

This nonrefundable credit is calculated by a base payment of 2500 plus an additional 417 per kilowatt hour that is in excess of 5 kilowatt hours. Any vehicles purchased after that date are no longer eligible for the Federal credit due to the number of vehicles manufactured. Depending on your location state and local utility incentives may be available for electric vehicles and solar systems.

In June 2021 New Jerseys Clean Energy Program NJCEP allocated a total of 7 million for Fiscal Year 2022 dedicating 6 million for use by state entities and 1 million for local governments. New Jersey just restarted its electric vehicle incentive program. On top of these revenue streams New Jersey has also granted residential solar a couple tax breaks to help keep the costs down.

I n November the Board allocated an additional 7 million for EV infrastructure investment in the program providing 14 million in funding for the local county and state. 2021 New Jersey is getting. Electric Vehicles on New Jersey State Cooperative Purchasing Contract.

Any idea on what Phase 2 in NJ will look like. That means youll. E-tron Sportback 2020-2022 7500.

Sales Tax Exemption - Zero Emission Vehicle ZEV Sales Tax Exemption - Zero Emission Vehicle ZEV NJSA. The proposal is scheduled to be published in the New Jersey Register dated April 19 2021. I think I read on this forum it will be summer 2021 if Im not mistakenm It seems like sales tax is still exempt for EV but any idea if the 5000 rebate will happen again.

NJ Tax Credit - Summer 2021. This was passed with a huge bipartisan majority. How Much is the Electric Vehicle Tax Credit for a 2021 Tesla.

The dates above reflect the extension. Buy and install new solar panels in New Jersey in 2021 with or without battery storage and qualify for the 26 federal solar tax credit. When you purchase your home solar system you will be 100 percent exempt from any sales tax due to the PV energy sales tax exemption.

Solar sales tax exemption. Jun 7 2021. Id love to see this post remain atop somehow of the Mid-Atlantic forum as it may be time sensitive.

New Jersey solar panel tax credits. There have been posts in the past regarding whether it would be 5000 going forward or would some pricing thresholds limit POS rebate. I ordered my Mach-E in Feb 2021 while the credit was still promised for the.

The IRS tax credit for 2021 Taxes ranges from 2500 to 7500 per new electric vehicle EV purchased for use in the US. Tesla cars bought after May 24 2021 would be retroactively eligible for a 7500 tax credit on 2021 tax returns. Nj Tesla Tax Credit 2021 2021 credit tesla Edit A proposed reformation of the ev tax credit threshold will enable gm and tesla to regain access for their future ev customers up to 7000 in tax credits on a new sales limit of 400000 electric vehicles in the us.

Tesla cars bought after December 31 2021 would be eligible for. I3 Sedan 2014-2021 7500. For Teslas bought on or after January 1 2020 there has been no federal tax credit.

I do feel as we are 14 of the way through June that if a July 1 resumption of the funding for credits is accurate. So based on the date of your purchase TurboTax is correct stating that the credit is not. Tesla Model 3 to be 5k cheaper in New Jersey with new incentive.

There was no grandfather clause. 0 0 You Save 5300 79990 Tesla 2021 Model S Plaid. Mustang Mach-E all 2021 trims 7500.

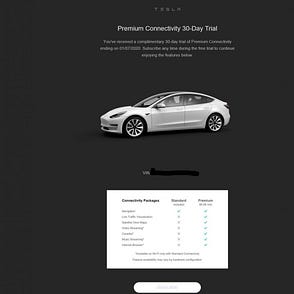

Tesla 2021 Model S long range 412. A copy of the proposal is available on the Departments webpages at. Charge Up NJ EV Rebate NJ State Sales Tax 6625 Cost After Incentives.

E-tron SUV 2019 2021-2022 7500. Beginning on January 1 2021.

Tesla Model 3 2021 In Middle Village Queens Long Island New Jersey Ny Road Masters Ii Inc 4619

Revamped Ev Tax Credit Tesla Toyota Honda Pushing Back Vs Union Made Bonus Tesla News

2021 Tesla Model S Plaid Zoom Auto Group Used Cars New Jersey

Revamped Ev Tax Credit Tesla Toyota Honda Pushing Back Vs Union Made Bonus Tesla News

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

The Ford Mustang Mach E Beats Tesla S Old 35 000 Promise

The Benefits Of Buying And Registering A Tesla In New Jersey By Onlyusedtesla Medium

Tesla S 7 500 Tax Credit Goes Poof But Buyers May Benefit Wired

N J Drivers Miss Out On 5k Rebate For Electric Cars If They Bought Them Earlier This Year Nj Com

Tesla Climbs As Other Ev Makers Hit Brakes After Rally Cna

Poll Are You Waiting For The Infrastructure Bill Before Ordering Page 13 Tesla Motors Club

The 2021 Tax Credits Will Take Tesla To The Moon Torque News

The Benefits Of Buying And Registering A Tesla In New Jersey By Onlyusedtesla Medium

2021 Used Tesla Model S 2021 Tesla S Plaid Self Drive Ready At Carpoint Auto Group Serving South River Nj Iid 21210089

Used 2021 Tesla Model Y For Sale In Illinois With Photos Cargurus

Electric Cars For Sale In Oklahoma City Ok Cargurus

/ap814720993638-5bfc383d46e0fb0051c14a81.jpg)

Tesla Cost Of Ownership Is It Worth It

2021 Tesla Model S Plaid Charlotte Nc 45603050

Used 2021 Tesla Model S Plaid Awd For Sale With Photos Cargurus